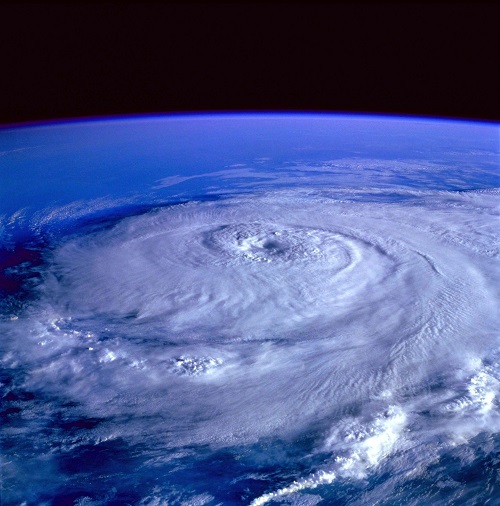

When Is It Hurricane Season in Texas?

June 1st marks the official start of the Atlantic hurricane season for Texas. This season lasts throughout the entire summer and doesn’t officially end until November 30th. In recent years, the National Oceanic and Atmospheric Administration (NOAA) has continued to predict above-average hurricane seasons which has even led the organization to consider moving the season to May 15th to adjust for this uptick in activity.

Peak Hurricane Season in Texas

Hurricane season in Texas reaches its apex beginning in the month of August and going through the middle of September.

This is traditionally when the Gulf of Mexico and surrounding waters are at their warmest creating the perfect conditions for tropical storms and hurricanes to form.

Homeowners should still be observant of hurricanes in Texas as well as potential tropical storms outside of the traditional and peak times they are posed to strike.

What Are the Hurricane Names for 2024?

Here is the official list of names for tropical cyclones during the hurricane season in 2024:

- Alberto

- Beryl

- Chris

- Debby

- Ernesto

- Francine

- Gordon

- Helene

- Isaac

- Joyce

- Kirk

- Leslie

- Milton

- Nadine

- Oscar

- Patty

- Rafael

- Sara

- Tony

- Valerie

- William

Hurricane Supplemental Name List

For better organization and due to the uptick in the number of storms, the World Meteorological Organization has forgone the practice of using the Greek alphabet for its Tropical Cyclone Programme and will now refer to a list of supplemental names that we hope will not become necessary, should the 2024 hurricane names list become exhausted:

- Adria

- Braylen

- Caridad

- Deshawn

- Emery

- Foster

- Gemma

- Heath

- Isla

- Jacobus

- Kenzie

- Lucio

- Makayla

- Nolan

- Orlanda

- Pax

- Ronin

- Sophie

- Tayshaun

- Viviana

- Will

The naming system for tropical cyclones continues to evolve. In the beginning, only the names of women were used, a practice that has long been replaced.

Some names are even retired from rotation after causing a notable amount of devastation, such as the infamous Houston hurricane, Hurricane Harvey.

The new practice of having a list of supplemental names can help all of us communicate better during emergencies, a key for any type of safety measure.

Texas Hurricane Risks

No state other than Florida has been hit by more hurricanes than Texas. NOAA is predicting the following outlook for the 2024 Atlantic Basin Hurricane Season:

- 14-21 Named Storms

- 6-10 Hurricanes

- 3-6 Major Hurricanes (Category 3 and up)

These numbers are only predictions, but they point to the continuing trend of a more active than normal hurricane season. A trend that is challenging the notion of what is normal in modern times.

Increased hurricane risks can occur for various reasons, including the impact that La Niña has on hurricanes in a positive manner.

Either way, this much activity puts millions of Texans at risk for damage involving wind damage and flood damage.

The Texans with the highest risks involving tropical storms and hurricanes are those along the Gulf Coast. The closer proximity to the coastline, the greater your risk will be, and so forth.

This means that homeowners along the Gulf Coast will need to consider various forms of flooding and other destructive perils that these storms can bring, and prepare accordingly.

Here are some of the regions within Texas that have the greatest risk involving hurricane damage:

- Port Arthur, TX–Beaumont, TX

- The Greater Houston, TX Metro Area

- Central Texas Gulf Coast such as Galveston, TX

- South Texas Gulf Coast including Corpus Christi, TX–Brownsville, TX

Just because hurricanes in Texas are more likely to cause damage to coastal regions, doesn’t mean that other parts of the state won’t feel their effects.

The remnants of a hurricane in Texas have the ability to travel well inland affecting cities as far as 200 miles inland.

This means that a hurricane in Houston can still cause damage in Central Texas near Austin or even as far as the Dallas-Fort Worth region.

A hurricane or tropical storm will bring in multiple threats to your home, putting you at risk for potential harm from flooding and wind.

Here are the main threats to consider that can damage your property:

- Excessive rain causes regional flooding.

- Storm surges can affect bodies of water miles inland as well as the coast causing severe flooding risks.

- Extreme wind shear can damage your home, vehicle, and additional forms of property through a number of means.

- Wind damage can also lead to additional damage due to exposure. For example, if your roof were to become damaged from the wind during a tropical storm in Texas and exposed to the elements, water damage could also become a problem as the rain could access the inside of your home.

It is important to understand the risks surrounding tropical storms and hurricanes to best prepare for them.

Preparation is key and can help you better protect your home and property as well as restore that which is lost during such extreme weather events.

Insurance Policies for Hurricane Season

There are many different insurance policies you’ll want to invest in to protect your home against the threats of hurricane season. For homeowners, this likely means the following:

- Homeowners insurance

- Flood insurance

- Auto insurance

Each type of insurance has an important role to play and can help you better stay protected against the many threats that are prevalent during tropical events.

Homeowners Insurance

A home insurance policy protects you all year long against many perils, but during hurricane season, its main fight will be against wind damage. This includes potential damage to your home, other structures on your property, and personal possessions.

Most standard home insurance policies include windstorm protection, but for homeowners who are in high-risk areas, an insurer may not provide such coverage, or may even have coverage that is beyond affordability. This is where the Texas Windstorm Insurance Association (TWIA) comes into play.

Homeowners who are in need of windstorm coverage can be provided with an applicable policy through TWIA.

Here at Freedom Insurance Group, our top-rated insurance providers offer plenty of home insurance options that provide windstorm coverage at an affordable rate that keeps you covered for less.

Note: you cannot receive windstorm coverage while there is a storm in the Gulf of Mexico. All Texans are encouraged to purchase a home insurance policy with windstorm protection as soon as possible to avoid a gap in coverage.

Flood Insurance

While a home insurance policy will protect you from damaging winds among many other perils, it will not protect you against flood damage. This is important because as we’ve mentioned, flooding can come in many different forms during a tropical storm that can easily damage your home.

Both the National Flood Insurance Program (NFIP) operated by FEMA and privately owned insurance companies offering flood insurance are available through Freedom Insurance Group.

We highly recommend flood insurance for all homeowners as rising flood threats are growing across most of the highly populated areas in Texas. Risk Factor™ can help you see which areas are most vulnerable.

Spoiler alert, homes on the Gulf Coast are expected to face most of the highest flood risks during hurricane season and all year long.

Note: Flood insurance policies have 30-day waiting periods in Texas. This means the longer you wait, the more you are exposing yourself to the risk of flooding without protection. It is important that homeowners secure appropriate flood coverage for their homes ahead of time to avoid coverage gaps.

Auto Insurance

Having an auto insurance policy is a must for Texas drivers because liability coverage is required by law. But if you are going to want to protect your vehicle from flooding or other weather-related perils such as wind damage or damage from a falling object, comprehensive coverage is a must.

It can be tempting to rely on the minimum level of coverage to save money but this short-term thinking can put you in a financial bind in the aftermath of experiencing a loss.

Through multi-policy discounts and bundling discounts, homeowners can combine home, auto, and flood coverages to receive a better form of protection all at a lower rate.

Bundle Your Insurance Policies To Save During Hurricane Season

A hurricane in Texas may not be preventable but a lack of coverage can be. Working together, your insurance policies can safeguard your home, property, and finances all at an affordable rate.

By bundling these insurance policies together, you can also receive great discounts, convenience, and the ability to close coverage gaps for a stronger layer of security.

The agents of Freedom Insurance Group are prepared to help you find the perfect coverage for your needs.

Through our established relationships with more than 25 top-rated insurance providers in the state of Texas, we can compare your coverage needs among many brands to discover the cheapest option for you at the lowest possible price.

Two of the best ways to save money come down to bundling policies and comparing your rates among a variety of providers.

This is what Freedom Insurance Group has modeled itself around since 2005, helping homeowners save an average of 40% on premiums while offering a wide range of coverage options.

As you can see, the insurance policies that protect you from hurricanes often come with time restraints, which is why we recommend all homeowners weigh their options sooner rather than later. Ask an agent how we can help you stay protected against hurricanes in Texas and year-round perils for less!