Texas Insurance Articles

Does switching home and auto insurance often raise my rates?

The Short Answer; Switching home and auto insurance frequently in pursuit of lower premiums might seem like a savvy financial strategy. However, this approach can sometimes backfire, leading to higher insurance costs in the long run by simply chasing teaser rates for new customers. Insurance companies know your entire insurance history and how often you…

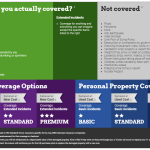

Read MoreTypes of Texas Home Insurance Policies and Coverages

Different types of Texas homeowners need different types of home insurance. Whether you’re a single-family homeowner, condo owner, mobile homeowner, or renter, there’s an insurance policy designed to protect what you own. We’ll explain what each home insurance policy type covers and how to make sure you get the coverage you need with this Ultimate…

Read MoreHow Much Does Electric Vehicle Insurance (EVs) Cost?

Electric Vehicles (EVs) have become increasingly popular, and as their presence on the roads grows, there has been considerable interest in how they impact auto insurance prices. Here’s an overview of the relationship between EVs and auto insurance: Potentially Higher Premiums: Repair Costs: One factor leading to potentially higher insurance premiums for EVs is the…

Read MoreForeclosed Homes in Texas: What To Know Before Purchasing

Foreclosed homes in Texas have different circumstances surrounding them than conventional homes including how you submit an offer, the process, and the speed of transactions.

Read MoreHow much does raising deductibles save on home insurance in Texas?

Raising deductibles on your Texas home insurance policy can result in savings on your premium, but the exact amount saved can vary significantly based on several factors. Most of the time, your home insurance deductible is based off of a percentage of your total coverage. For example, let’s say you have a 1% deductible for…

Read MoreRaising my auto insurance deductibles, how much does it save in Texas?

The savings achieved by raising auto insurance deductibles in Texas can vary widely based on a myriad of factors. Here are some general considerations and steps to estimate your potential savings: Factors Influencing Savings: Type of Coverage: The savings can be different for collision and comprehensive coverages. Vehicle Value: Cars that are more expensive to…

Read MoreHow Comprehensive Insurance Protects Drivers in Texas

Comprehensive coverage protects you from various random acts which can cause harm to your automobile outside of having an accident. For example, if you were to be hit by a vehicle, the guilty party’s liability coverage is there to restore your property and other bills such as legal and medical expenses.

Read MoreThe Meaning of ” Full Coverage” in Auto Insurance

“Full coverage” in the context of auto insurance is a colloquial term that typically refers to a combination of insurance coverages that protect both you and your vehicle. It’s not a technical or official term in the insurance industry, but when people refer to “full coverage,” they usually mean a combination of the following types…

Read MoreEverything you need to know about the home insurance claims process

Home insurance claims can be a bit daunting if you’ve never navigated the process before. Here’s a comprehensive overview: 1. Understand Your Policy: Before you can file a claim, it’s essential to understand what your policy covers. Most standard homeowners insurance policies provide coverage for: Dwelling (your home’s structure) Other structures (sheds, fences, etc.) Personal…

Read MoreThe History and Meaning of the term “Hazard Insurance”

“Hazard insurance” refers to insurance coverage that protects property owners against damage caused by natural disasters, such as storms, fires, earthquakes, and floods. The term “hazard” in this context represents anything that can cause damage to a property. The term can mean different things to different people, so whenever hearing the words “hazard insurance” in…

Read More