Does My Texas Auto Insurance Cover Rental Cars?

Making sure everything is in order is important when renting a vehicle. Rental cars can be necessary when taking a trip, after an accident, or even celebrating an occasion. Texas rental car companies can provide temporary solutions to your vehicle needs, but what happens should you become involved in a wreck while using their vehicle?

There are a lot of considerations that you’ll likely have and the world of insurance can be complex and intimidating. Freedom Insurance Group is proud to be a resource to drivers throughout Texas and we’re here to help break things down so that you don’t have to overpay for coverage but will remain protected while driving rental cars.

Does My Auto Insurance Cover Rental Cars in Texas?

Yes, while there are some exceptions, your car insurance policy extends to your rental vehicle. It will cover you while driving rental cars in the state of Texas. This extension includes liability, collision, comprehensive, and by default, full coverages, as full coverage is simply a combination of the three.

The important aspect drivers need to consider, however, is their auto insurance policy’s limits. If you are involved in an accident while driving a rental car where the damage is higher than your policy allows for and you are at fault, you’ll need additional forms of protection or you may be forced to pay to restore the loss out of your own pocket.

Rental Car Insurance Offered by Rental Car Companies

Rental cars provide the perfect example of why having more than the bare minimum auto insurance coverage can be helpful. Many incidents outside of a simple car accident can cost you thousands of dollars, but if you are properly insured, you can mitigate the costs and restore the loss with greater ease.

Knowing your car insurance’s policy limits can help you decide what rental car insurance policies you need and others you may be able to skip.

Considering rental car companies offer these protections by charging you per day, depending on the length of your rental, the costs can begin to add up quickly.

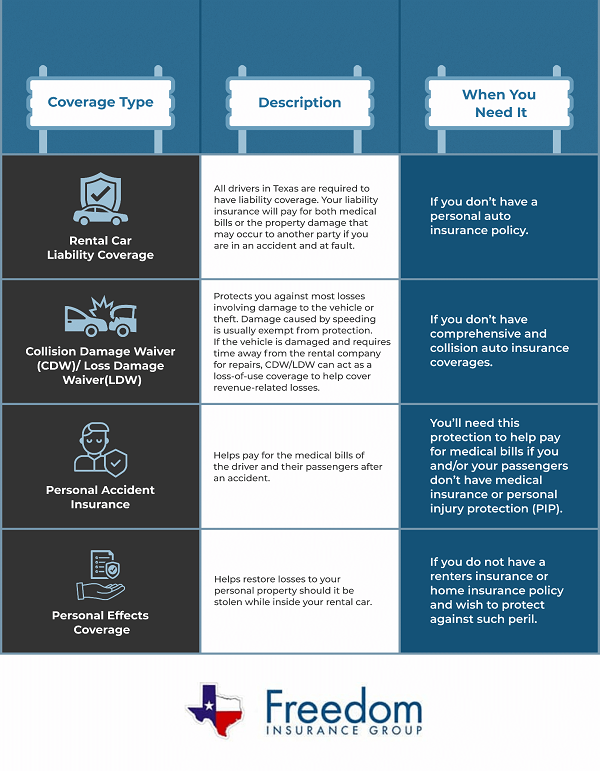

Take a closer look at your insurance options and when to purchase additional protection:

Should You Buy Rental Car Insurance in Texas?

Again, each situation is different and the amount of rental car insurance you’ll need when using rental cars will come down to the level of auto insurance you possess.

As listed above, you can decide which coverages make sense based on your personal car insurance policy to stay covered but avoid overpaying.

Don’t just take our word for it, the Texas Department of Insurance (TDI) has also put together some helpful FAQs on the subject and can help you decide whether or not you need to buy rental insurance while renting a vehicle.

The same logic will apply both in Texas and in other states. If you are on vacation, you’ll need to make sure that your rental car is properly covered and that you aren’t overpaying for coverage you don’t need.

Things can get a bit more complicated when renting a vehicle internationally, however, where rental car insurance may be mandatory. Before any trips outside of Texas, you should consult with your insurance company as well as any travel services to be sure that you are covered for potential losses.

What Happens if You Crash a Rental Car Without Insurance?

If you rent a car without insurance and are involved in an accident, things can very expensive, very quickly. Here are a few factors that will come into play during such a scenario:

- Are you at fault?

- Was anyone hurt in the accident?

- Are you without all forms of insurance or only a policy from the rental car company?

- Does your personal car insurance policy or credit cards offer coverage?

- Are you partially covered? For example, do you have liability but are without collision coverage or a rental company policy?

All of these factors, and potentially others, will come into play, presenting different outcomes with each. However, the bottom line is, that if you are driving a rental car vehicle that is involved in an accident and you are found to be at fault, you’ll either need to have the right coverages in place ahead of time or face paying to restore such losses on your own.

Failure to do so can leave any other party involved in the accident with the option to sue you and/or the rental car company to restore their losses. It’s also probable that you’ll face legal action from the rental car company which will look to you to restore any losses or possible legal expenses that are brought about because of your accident.

On average, Texans can expect to pay more than $15,000 per accident for bodily injuries. Physical damage is often an average higher than $3,000 per accident, which may rise higher due to economic factors that can affect the cost of parts and labor, such as inflation.

These expenses can be a lot to bear unexpectedly, which is why having the right auto insurance policies in place is critical.

It’s also a reminder as to why additional coverages may raise your premium each month but can end up saving you thousands of dollars in the long run.

In Texas, every driver is only required to keep liability coverage, but without additional forms of coverage, you can be stuck paying for these losses without a financial safety net.

It’s important to review your coverage at least annually and to manage your risks accordingly. This benefits both your personal use and your rental car usage.

Credit Cards and Renting a Vehicle

Some credit card companies offer various rewards to their customers including rental car insurance. This is an important perk while renting because it can help you stay protected when you require a rental vehicle.

There are some vehicles that are not covered and additional exclusions that may apply. With so many credit cards available to consumers, it’s also a great idea to double-check with your credit card company beforehand to learn the specific details of your personal card’s terms.

To learn more, check out our sister piece covering rental car insurance and credit cards.

Questions About Car Insurance? Ask an Agent

It’s better to know what you’re getting into before stepping into any rental car and a licensed auto insurance agent can help. Rental car companies are there to upsell and if you aren’t careful, you might overpay for coverage you may not need. But in the same sense, you don’t want to risk renting a vehicle without adequate coverage.

Our team is proud to be a resource for drivers and is here to help. Ask an agent about your auto insurance and rental situation to learn more about the right coverage to keep you protected without paying too much money.

We’re experts at helping drivers in Texas stay protected and saving money. On average, drivers who switch can save 40% on their auto insurance premiums.

Freedom Insurance Group only works with the best of the best and offers our clients car insurance policies from over 25 top-rated insurance providers across Texas through our insurance center.

By doing so, we can compare your rates and find the best coverage at the lowest price. See how much you can save by receiving an auto insurance quote from our online tool.