Homeowners Insurance & Hosting Your 2022 New Year’s Eve Party

As we prepare to ring in the new year, homes across Texas and the world are ready to celebrate, hoping for the best that is to come. Even with all of the disruptions the last few years have presented, coming together with loved ones to reflect on the year and welcome a new one is a time-honored tradition. But failing to properly plan your New Year’s Eve party can spell disaster.

Homeowners have a responsibility to their homes, family, and guests to ensure not only a good time but also a responsible one. The last thing you want to do is end your year with tragedy. There are many physical and financial setbacks you could face after a party and as a host, or a guest, knowing what to do beforehand can make all of the difference. Take a closer look at these quick tips on celebrating a safe and happy New Year this season!

Encourage Ridesharing and Taxis to Stay Safe and Reduce Liability

There are plenty of benefits for having your guests use a ridesharing app or a taxi service and they begin with keeping everyone safe. Driving under the influence is never okay and NYE is a prime time for people to let go of their inhibitions which could lead to an irresponsible decision.

Keeping your guests safe is also important because as a homeowner, guests who drive impaired or are overserved and harm another party could leave you liable in the state of Texas. When you consider that hosting a party may lead to parking issues and fewer vehicles could provide more space for outdoor activities depending on where you live, having guests catch a ride is a no-brainer.

Go With the Flow

Hosting a party as a homeowner can be a stressful event. There are guests to coordinate, food to prepare, an atmosphere to set, events to plan, and much more. Going with the flow can help you ease your stress levels and gain more enjoyment from your gathering. Supply chain issues persist, COVID-19 outbreaks are sadly still around, and all of this plus regular life issues may cause last-minute cancellations. Have a contingency plan for the big stuff and remember not to sweat the small stuff. You’ll have a better time if you do.

As a Homeowner, Minimize Your Risks

Jumping off of that trampoline into your pool may feel like a good idea at the moment, but the consequences may be dire. There are plenty of ways that you as a host can help reduce your liability risks by keeping your guests safe. Here are a few helpful ideas to keep the night rolling responsibly:

- Consider hiring a TABC Certified bartender to serve guests responsibly.

- Extend an invitation to intoxicated guests to spend the night in your guest room or on your sofa.

- Keep your valuables and your firearms locked up in a secure place. This is a great way to reduce theft or potentially deadly outcomes.

- Host sick guests virtually to reduce the spread of germs to other guests and use social distancing when appropriate.

- Avoid risky behaviors which may result in injury.

When guests are injured while visiting your home, as a homeowner, you can be held liable. A home insurance and umbrella policy will help mitigate medical and legal expenses, but it may not be enough. On top of this, safety is always the top priority and by eliminating risky behavior, everyone can enjoy your party with peace of mind.

Stay Vigilant as Car Thieves Prepare to Strike

Preventing car theft during the holidays is important as New Year’s Eve and New Year’s Day both rank in the top five holidays where car thieves will strike. This is yet another reason it is a great idea for everyone to keep their cars home in secure areas such as a locked, armed garage. Be sure to practice common sense by keeping your vehicles locked, hiding valuables, and keeping them in well-lit, secure areas whenever possible.

Your home insurance policy will protect your personal possessions in most cases. If your vehicle is broken into and valuables are stolen, your policy will step in to help you restore the loss. Restoring damage to your vehicle or your vehicle altogether should it become stolen, however, will require the right auto insurance policy.

The key here is the right auto insurance policy as there are many different types of coverage. Comprehensive insurance is the coverage built for this and drivers who are lacking such protection may find themselves stuck in the aftermath of theft involving a vehicle picking up the pieces alone. Mitigate your risks and prepare for more with proper comprehensive insurance coverage to help you during your New Year’s celebrations and all year round.

Skip the Fireworks, Your Home Insurance Policy Will Thank You

On average, fireworks start 18,500 fires every year. If fireworks are legal where you live, your homeowners insurance policy will likely cover the damage, but you’ll still have to deal with the losses and a likely steep rate increase. Although one of the rarest home insurance claims, fire damage continues to lead the list as the most expensive claim on average for homeowners.

Freedom Insurance Group is proud to be from Flower Mound, Texas, but like many Denton County cities, fireworks are prohibited in FloMo. This means that beyond legal trouble, using fireworks that lead to damage to your home, cause damage elsewhere, or cause physical harm to someone, you’ll likely be paying to restore these losses out of your own pocket. If fireworks are non-negotiable, it’s best to let the professionals handle it at one of the many local events set to celebrate.

Keep a Shortlist of Emergency Services

Homeowners can carefully plan and act as responsibly as possible, but accidents may still happen. It is important to stay prepared to alert the proper authorities if needed to minimize damage and keep everyone as safe as possible. Be sure to save these local emergency services’ contact information to prepare for the worst as we all do our part to ensure it is the best:

*Remember, the best number for any pressing emergency is 911, however, enjoy these local resources as a guide.

Flower Mound, Texas:

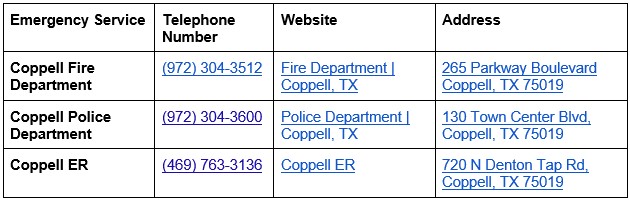

Coppell, Texas:

Breckenridge, Texas:

Reduce Your Risk and Ring in the New Year Responsibly

Here at Freedom Insurance Group, we wish nothing more than a happy and prosperous New Year. We hope that you will celebrate responsibility and hope that the holiday rings in plenty of joy for you and your loved ones. But we understand that accidents may happen, judgments may become lapsed, and mitigating your losses shifts from the unthinkable into the imperative. Responsibility is key for any celebration and as a homeowner, it is your responsibility to remain protected with the proper coverages and to prevent irresponsible actions before they begin.

Homeowners insurance is a tool to protect your home and valuables, as well as your family from liability. For additional coverage against liability, umbrella policies are available. Automobiles require auto insurance, which boasts a range of coverage options. Together, homeowners can protect their property, their assets, and their families by minimizing coverage gaps.

Through bundling, our agents can provide the right coverages for your needs while offering considerable discounts on your protection. We work with more than 25 top-rated insurance brands that enable us to compare your coverages among a variety of providers, ensuring the lowest possible price for your protection. Freedom Insurance Group helps our clients save 40% on average for their insurance needs. Contact us today or feel free to use one of our free online quote tools below: