Summary of Named Perils vs Open Perils Coverages For Texas Home Insurance

Summary of Named Perils / Broad Coverage

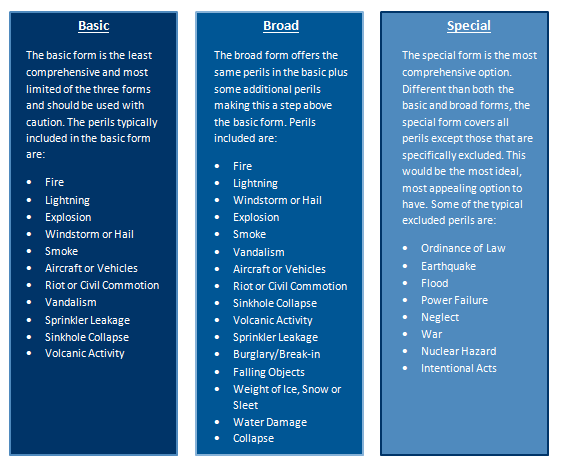

Basically, insurance companies write two types of policies for homeowners: named peril and open peril policies.

The “named peril” insurance policy covers only what is specifically listed in the policy. The named peril insurance policy only covers specific perils, so it is usually less expensive than an open peril insurance policy. Please note, sometimes named peril coverage is called broad coverage and open peril coverage is called special coverage.

A typical named peril policy would cover:

1. Fire or Lightening

2. Windstorm

3. Hail

4. Accidental Escape of Water or Steam

5. Theft

6. Explosion

7. Riot or civil commotion

8. Aircraft

9. Vehicles

10. Smoke

11. Vandalism or malicious mischief

12. Falling objects

13. Weight of ice or snow/sleet

14. Freezing of plumbing, heating and more

15. Breakage of Glass

16. Freezing and thawing causing water to back up under roofing

When coverage is written as a named peril basis, the burden is on you, the insured, to prove that one of the named perils caused the loss.

Summary of Open Perils / “All Risk” or Special Coverage

An “open peril” policy covers everything that is not specifically excluded in the insurance policy. The all-risk insurance policy usually costs more than the named peril policy because it offers more comprehensive coverage. Also, under an open peril policy, the burden is not on you, but on the insurance company, to prove that the peril causing the damage is not excluded; if it’s not excluded then coverage applies. The exclusions and limitations are the key to determining what coverage is provided by the policy.

The most common perils excluded in an open peril policy, but could be added back in via endorsement or a separate policy, include:

- War

- Flood, mudslide, seepage & sewer backup (and sometimes surface water that builds up after heavy rains, underwater springs, groundwater, burst water pipes, overflowing toilets, and wind or wave-driven water)

- Governmental seizure or destruction of property

- Boiler explosion

- Off-premises utility service interruption

- Building ordinance or law

- Seepage or leakage of water over a period of time

- Electrical damage to electrical devices

- Employee dishonesty

- Wear and tear; rust, corrosion, fungus, decay, deterioration, hidden or latent defect smog; settling, cracking, shrinking, or expansion; nesting, infestation or release of secretions by insects, birds, rodents or animals

- Damage to building interiors by rain, snow, sleet, ice, sand, or dust unless the roof or walls are first damaged – except damage by thawing of snow, ice or sleet

- Mechanical breakdown

- Theft of building materials and supplies not yet attached to buildings

- Pollution

- Earthquake or earth movement

Some examples that an open peril policy would add in contrast to a named peril policy are:

- an unbalanced washing machine took a walk and damaged the hot water heater;

- a window left open in a rainstorm allowed water to damage the interior walls and floor;

- water backed up on the roof, causing leaks, where no physical damage was done to the roof;

- a fence was damaged by the new 16-year-old driver of the family car;

- while a homeowner was moving a large dresser, it rolled down the stairs and through a wall damaging flooring as well;

- a homeowner’s young child with a hammer did some redecorating;

- a homeowner missed the joists while attic walking and fell through the ceiling;

- a deer bled and roughed up the interior of the home after jumping through a picture window;

- a chandelier fell while it was being cleaned;

- a furnace working overtime due to a faulty thermostat warped cupboards and ruined drapes

- a countertop was scorched from a hot appliance.

Click Here For Our Ultimate Texas Home Insurance Coverages Guide